Distributed Marginal Value-at-Risk Simulation

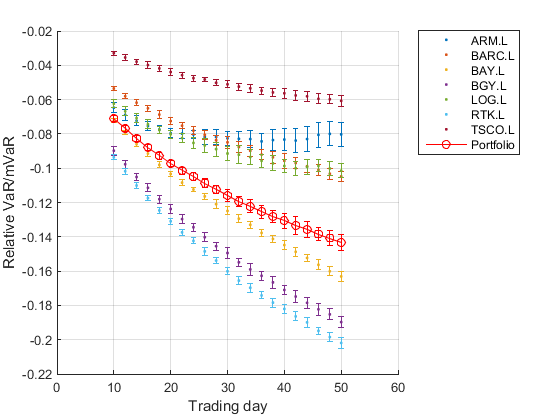

This example uses the Parallel Computing Toolbox™ to perform a Monte Carlo simulation of a number of stocks in a portfolio. At a given confidence level, we predict the value at risk (VaR) of the portfolio as well as the marginal value at risk (mVaR) of each of the stocks in the portfolio. We also provide confidence intervals for our estimates.

For details about the computations, view the code for pctdemo_setup_mvarview the code for pctdemo_setup_mvar.

Prerequisites:

Related examples:

Analyze the Sequential Problem

First, we look at how the computations in the sequential example fit into the model introduced in the Dividing MATLAB Computations into Tasks example. The main computations in the sequential example consist of calling pctdemo_task_mvar to perform repeated simulations. Each simulation takes only a few seconds, so we have each task perform many such simulations. Because the function pctdemo_task_mvar can already perform many simulations in a single function call, we can use it directly as our task function.

Load the Example Settings and the Data

The example uses the default profile when identifying the cluster to use. The profiles documentationprofiles documentation explains how to create new profiles and how to change the default profile. See Customizing the Settings for the Examples in the Parallel Computing Toolbox for instructions on how to change the example difficulty level or the number of tasks created.

[difficulty, myCluster, numTasks] = pctdemo_helper_getDefaults();

We obtain the performance of the stocks, their weights in our portfolio, and other input data from pctdemo_setup_mvar. The number of repetitions, numTimes, is determined by the difficulty parameter. You can view the code for pctdemo_setup_mvarview the code for pctdemo_setup_mvar for full details.

[fig, numSims, numTimes, stock, names, weights, time, confLevel] = ...

pctdemo_setup_mvar(difficulty);

Let's look at the confidence level at which we are calculating the VaR and mVaR.

fprintf('Calculating VaR and mVaR at the %3.1f%% confidence level.\n', ... confLevel); startTime = clock;

Calculating VaR and mVaR at the 95.0% confidence level.

Divide the Work into Smaller Tasks

We divide the numTimes repetitions of the simulations among the numTasks tasks.

[splitTimes, numTasks] = pctdemo_helper_split_scalar(numTimes, numTasks); fprintf(['This example will submit a job with %d task(s) ' ... 'to the cluster.\n'], numTasks);

This example will submit a job with 4 task(s) to the cluster.

Create and Submit the Job

We create the job and the tasks in the job. We let the task function in task i perform splitTimes(i) repetitions of the simulations. You can view the code for pctdemo_task_mvarview the code for pctdemo_task_mvar for full details.

job = createJob(myCluster); for i = 1:numTasks createTask(job, @pctdemo_task_mvar, 2, ... {splitTimes(i), stock, weights, time, numSims, confLevel}); end

We can now submit the job and wait for it to finish.

submit(job); wait(job);

Retrieve the Results

Let us obtain the job results, verify that all the tasks finished successfully, and then delete the job. fetchOutputs will throw an error if the tasks did not complete successfully, in which case we need to delete the job before throwing the error.

try jobResults = fetchOutputs(job); catch err delete(job); rethrow(err); end

We collect the task results.

VaR = cat(1, jobResults{:, 1});

mVaR = cat(1, jobResults{:, 2});

We have now finished all the verifications, so we can delete the job.

delete(job);

Measure the Elapsed Time

The time used for the distributed computations should be compared against the time it takes to perform the same set of calculations in the Sequential Marginal Value-at-Risk Simulation example. The elapsed time varies with the underlying hardware and network infrastructure.

elapsedTime = etime(clock, startTime);

fprintf('Elapsed time is %2.1f seconds\n', elapsedTime);

Elapsed time is 6.9 seconds

Plot the Results

We use pctdemo_plot_mvar to create a graph of the value at risk of our portfolio at the given confidence level. The graph also shows the marginal value at risk of the individual stocks in our portfolio at that same confidence level. You can view the code for pctdemo_plot_mvarview the code for pctdemo_plot_mvar for full details.

pctdemo_plot_mvar(fig, VaR, mVaR, time, names);