Mixed-Integer Quadratic Programming Portfolio Optimization

This example shows how to solve a Mixed-Integer Quadratic Programming (MIQP) portfolio optimization problem using the intlinprog Mixed-Integer Linear Programming (MILP) solver. The idea is to iteratively solve a sequence of MILP problems that locally approximate the MIQP problem.

Problem Outline

As Markowitz showed ("Portfolio Selection," J. Finance Volume 7, Issue 1, pp. 77-91, March 1952), you can express many portfolio optimization problems as quadratic programming problems. Suppose that you have a set of N assets and want to choose a portfolio, with

being the fraction of your investment that is in asset

being the fraction of your investment that is in asset

. If you know the vector

. If you know the vector

of mean returns of each asset, and the covariance matrix

of mean returns of each asset, and the covariance matrix

of the returns, then for a given level of risk-aversion

of the returns, then for a given level of risk-aversion

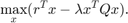

you maximize the risk-adjusted expected return:

you maximize the risk-adjusted expected return:

The quadprog solver addresses this quadratic programming problem. However, in addition to the plain quadratic programming problem, you might want to restrict a portfolio in a variety of ways, such as:

Having no more than

Massets in the portfolio, whereM <= N.Having at least

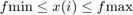

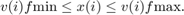

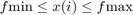

massets in the portfolio, where0 < m <= M.Having semicontinuous constraints, meaning either

, or

, or

for some fixed fractions

for some fixed fractions

and

and

.

.

You cannot include these constraints in quadprog. The difficulty is the discrete nature of the constraints. Furthermore, while the mixed-integer linear programming solver intlinprog does handle discrete constraints, it does not address quadratic objective functions.

This example constructs a sequence of MILP problems that satisfy the constraints, and that increasingly approximate the quadratic objective function. While this technique works for this example, it might not apply to different problem or constraint types.

Begin by modeling the constraints.

Modeling Discrete Constraints

is the vector of asset allocation fractions, with

is the vector of asset allocation fractions, with

for each

for each

. To model the number of assets in the portfolio, you need indicator variables

. To model the number of assets in the portfolio, you need indicator variables

such that

such that

when

when

, and

, and

when

when

. To get variables that satisfy this restriction, set the

. To get variables that satisfy this restriction, set the

vector to be a binary variable, and impose the linear constraints

vector to be a binary variable, and impose the linear constraints

These inequalities both enforce that

and

and

are zero at exactly the same time, and they also enforce that

are zero at exactly the same time, and they also enforce that

whenever

whenever

.

.

Also, to enforce the constraints on the number of assets in the portfolio, impose the linear constraints

Objective and Successive Linear Approximations

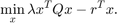

As first formulated, you try to maximize the objective function. However, all Optimization Toolbox™ solvers minimize. So formulate the problem as minimizing the negative of the objective:

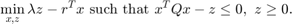

This objective function is nonlinear. The intlinprog MILP solver requires a linear objective function. There is a standard technique to reformulate this problem into one with linear objective and nonlinear constraints. Introduce a slack variable

to represent the quadratic term.

to represent the quadratic term.

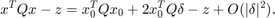

As you iteratively solve MILP approximations, you include new linear constraints, each of which approximates the nonlinear constraint locally near the current point. In particular, for

where

where

is a constant vector and

is a constant vector and

is a variable vector, the first-order Taylor approximation to the constraint is

is a variable vector, the first-order Taylor approximation to the constraint is

Replacing

by

by

gives

gives

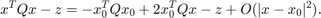

For each intermediate solution

you introduce a new linear constraint in

you introduce a new linear constraint in

and

and

as the linear part of the expression above:

as the linear part of the expression above:

This has the form

, where

, where

, there is a

, there is a

multiplier for the

multiplier for the

term, and

term, and

.

.

This method of adding new linear constraints to the problem is called a cutting plane method. For details, see J. E. Kelley, Jr. "The Cutting-Plane Method for Solving Convex Programs." J. Soc. Indust. Appl. Math. Vol. 8, No. 4, pp. 703-712, December, 1960.

MATLAB® Problem Formulation

To express problems for the intlinprog solver, you need to do the following:

Decide what your variables represent

Express lower and upper bounds in terms of these variables

Give linear equality and inequality matrices

Have the first

variables represent the

variables represent the

vector, the next

vector, the next

variables represent the binary

variables represent the binary

vector, and the final variable represent the

vector, and the final variable represent the

slack variable. There are

slack variable. There are

variables in the problem.

variables in the problem.

Load the data for the problem. This data has 225 expected returns in the vector r and the covariance of the returns in the 225-by-225 matrix Q. The data is the same as in the Using Quadratic Programming on Portfolio Optimization Problems example.

load port5

r = mean_return;

Q = Correlation .* (stdDev_return * stdDev_return');

Set the number of assets as N.

N = length(r);

Set indexes for the variables

xvars = 1:N; vvars = N+1:2*N; zvar = 2*N+1;

The lower bounds of all the 2N+1 variables in the problem are zero. The upper bounds of the first 2N variables are one, and the last variable has no upper bound.

lb = zeros(2*N+1,1); ub = ones(2*N+1,1); ub(zvar) = Inf;

Set the number of assets in the solution to be between 100 and 150. Incorporate this constraint into the problem in the form, namely

by writing two linear constraints of the form

:

:

M = 150; m = 100; A = zeros(1,2*N+1); % Allocate A matrix A(vvars) = 1; % A*x represents the sum of the v(i) A = [A;-A]; b = zeros(2,1); % Allocate b vector b(1) = M; b(2) = -m;

Include semicontinuous constraints. Take the minimal nonzero fraction of assets to be 0.001 for each asset type, and the maximal fraction to be 0.05.

fmin = 0.001; fmax = 0.05;

Include the inequalities

and

and

as linear inequalities.

as linear inequalities.

Atemp = eye(N); Amax = horzcat(Atemp,-Atemp*fmax,zeros(N,1)); A = [A;Amax]; b = [b;zeros(N,1)]; Amin = horzcat(-Atemp,Atemp*fmin,zeros(N,1)); A = [A;Amin]; b = [b;zeros(N,1)];

Include the constraint that the portfolio is 100% invested, meaning

.

.

Aeq = zeros(1,2*N+1); % Allocate Aeq matrix

Aeq(xvars) = 1;

beq = 1;

Set the risk-aversion coefficient

to

to 100.

lambda = 100;

Define the objective function

as a vector. Include zeros for the multipliers of the

as a vector. Include zeros for the multipliers of the

variables.

variables.

f = [-r;zeros(N,1);lambda];

Solve the Problem

To solve the problem iteratively, begin by solving the problem with the current constraints, which do not yet reflect any linearization. The integer constraints are in the vvars vector.

options = optimoptions(@intlinprog,'Display','off'); % Suppress iterative display [xLinInt,fval,exitFlagInt,output] = intlinprog(f,vvars,A,b,Aeq,beq,lb,ub,options);

Prepare a stopping condition for the iterations: stop when the slack variable

is within 0.01% of the true quadratic value.

is within 0.01% of the true quadratic value.

thediff = 1e-4; iter = 1; % iteration counter assets = xLinInt(xvars); % the x variables truequadratic = assets'*Q*assets; zslack = xLinInt(zvar); % slack variable value

Keep a history of the computed true quadratic and slack variables for plotting.

history = [truequadratic,zslack];

Compute the quadratic and slack values. If they differ, then add another linear constraint and solve again.

In toolbox syntax, each new linear constraint

comes from the linear approximation

comes from the linear approximation

You see that the new row of

and the new element in

and the new element in

, with the

, with the

term represented by a -1 coefficient in

term represented by a -1 coefficient in

.

.

After you find a new solution, use a linear constraint halfway between the old and new solutions. This heuristic way of including linear constraints can be faster than simply taking the new solution. To use the solution instead of the halfway heuristic, comment the "Midway" line below, and uncomment the following one.

while abs((zslack - truequadratic)/truequadratic) > thediff % relative error newArow = horzcat(2*assets'*Q,zeros(1,N),-1); % Linearized constraint A = [A;newArow]; b = [b;truequadratic]; % Solve the problem with the new constraints [xLinInt,fval,exitFlagInt,output] = intlinprog(f,vvars,A,b,Aeq,beq,lb,ub,options); assets = (assets+xLinInt(xvars))/2; % Midway from the previous to the current % assets = xLinInt(xvars); % Use the previous line or this one truequadratic = assets'*Q*assets; zslack = xLinInt(zvar); history = [history;truequadratic,zslack]; iter = iter + 1; end

Examine the Solution and Convergence Rate

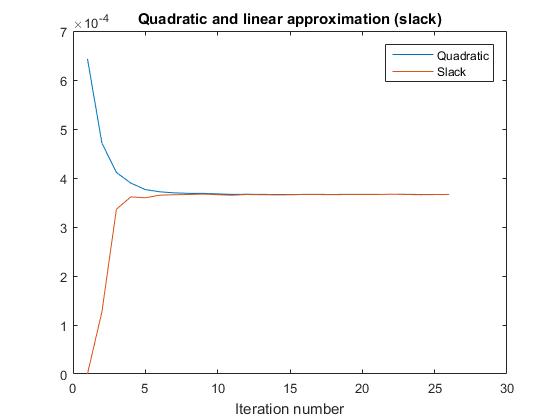

Plot the history of the slack variable and the quadratic part of the objective function to see how they converged.

plot(history) legend('Quadratic','Slack') xlabel('Iteration number') title('Quadratic and linear approximation (slack)')

What is the quality of the MILP solution? The output structure contains that information. Examine the absolute gap between the internally-calculated bounds on the objective at the solution.

disp(output.absolutegap)

0

The absolute gap is zero, indicating that the MILP solution is accurate.

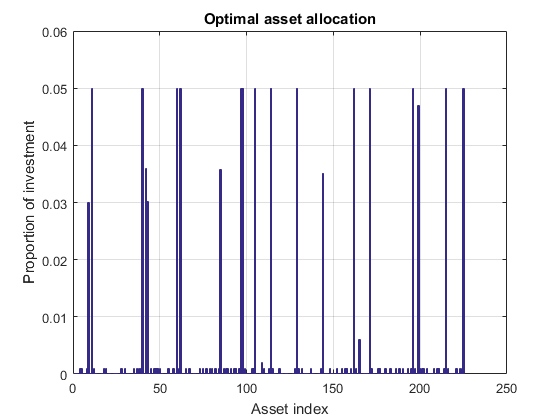

Plot the optimal allocation. Use xLinInt(xvars), not assets, because assets might not satisfy the constraints when using the midway update.

bar(xLinInt(xvars)) grid on xlabel('Asset index') ylabel('Proportion of investment') title('Optimal asset allocation')

You can easily see that all nonzero asset allocations are between the semicontinuous bounds

and

and

.

.

How many nonzero assets are there? The constraint is that there are between 100 and 150 nonzero assets.

sum(xLinInt(vvars))

ans = 100

What is the expected return for this allocation, and the value of the risk-adjusted return?

fprintf('The expected return is %g, and the risk-adjusted return is %g.\n',... r'*xLinInt(xvars),-fval)

The expected return is 0.000616464, and the risk-adjusted return is -0.0360334.

More elaborate analyses are possible by using features specifically designed for portfolio optimization in Financial Toolbox™.