Example: Web-Based Bond Pricing Tool Using JavaScript

This example shows how to create a web application that calculates the price of a bond from a simple formula. It uses the MATLAB® Production Server™ RESTful API and JSON Representation of MATLAB Data Types to depict an end-to-end workflow of using MATLAB Production Server. You run this example by entering the following known values into a web interface:

Face value (or value of bond at maturity) —

MCoupon payment —

CNumber of payments —

NInterest rate —

i

The application calculates price (P) based on the following equation:

P = C * ( (1 - (1 + i)^-N) / i ) + M * (1 + i)^-N

Step 2: Create a Deployable Archive with the Production Server Compiler App

Step 4: Enable Cross-Origin Resource Sharing (CORS) on the Server

Step 5: Write JavaScript Code using the RESTful API and JSON

Step 1: Write MATLAB Code

Write the following code in MATLAB to price bonds. Save the code using the filename pricecalc.m.

function price = pricecalc(face_value, coupon_payment,... interest_rate, num_payments) M = face_value; C = coupon_payment; N = num_payments; i = interest_rate; price = C * ( (1 - (1 + i)^-N) / i ) + M * (1 + i)^-N;

Step 2: Create a Deployable Archive with the Production Server Compiler App

To create the deployable archive for this example:

On the Apps tab, select the Production Server Compiler App.

In the Application Type list, select Deployable Archive.

In the Exported Functions field, add

pricecalc.m.Under Archive information, change

pricecalctoBondTools.Click Package.

The generated deployable archive, BondTools.ctf is located in the for_redistribution folder of the project.

Step 3: Place the Deployable Archive on a Server

Download the MATLAB Runtime, if needed, at http://www.mathworks.com/products/compiler/mcr. See Download and Install the MATLAB Runtime for more information.

Create a server using

mps-new. See Create a Server for more information. If you haven't already setup your server environment, seemps-setupfor more information.If you have not already done so, specify the location of the MATLAB Runtime to the server by editing the server configuration file,

main_configand specifying a path for--mcr-root. See Edit the Configuration File for details.Start the server using

mps-start, and verify it is running withmps-status.Copy the

BondTools.ctffile to theauto_deployfolder on the server for hosting.

Step 4: Enable Cross-Origin Resource Sharing (CORS) on the Server

Enable Cross-Origin Resource Sharing (CORS) by editing the server configuration file, main_config and specifying the list of domains origins from which requests can be made to the server. For example, setting the cors-allowed-origins option to --cors-allowed-origins * allows requests from any domain to access the server. See cors-allowed-origins and Edit the Configuration File for details.

Step 5: Write JavaScript Code using the RESTful API and JSON

Using the RESTful API and JSON Representation of MATLAB Data Types as a guide, write the following JavaScript® code. Save this code as a JavaScript file named calculatePrice.js.

Code:

Step 6: Embed JavaScript within HTML Code

Embed the JavaScript from the previous step within the following HTML code by using the following syntax:

<script src="calculatePrice.js" type="text/javascript"></script>

Save this code as an HTML file named bptool.html.

Code:

Step 7: Run Example

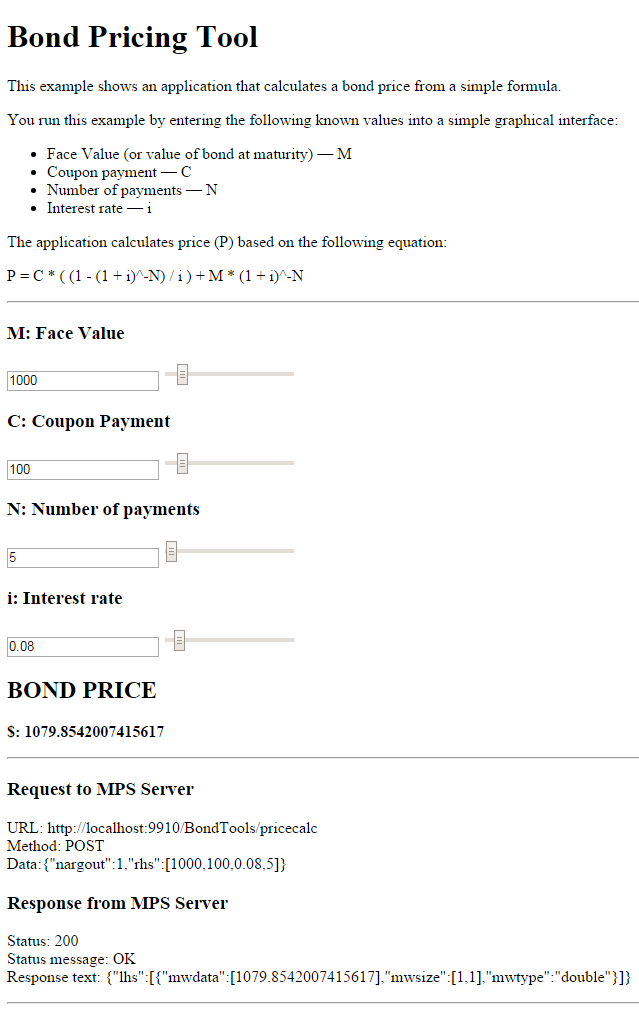

Assuming, the server with the deployed MATLAB function is up and running, open the HTML file bptool.html in a web browser. The default bond price is NaN because no values have been entered as yet. Try the following values to price a bond:

Face Value = $1000

Coupon Payment = $100

Number of payments = 5

Interest rate = 0.08 (Corresponds to 8%)

The resulting bond price is $1079.85

You can use the sliders in the tool price different bonds. Varying the interest rate results in the most dramatic change in the price of the bond.